Down payment chain

A down payment, which is sometimes referred to as an advance payment, or ex gratis payment, is when part of a contractual sum is paid in advance of the exchange, i.e. before any work has been done or goods supplied. Down payments are typically recorded as prepaid expenses by the payer and recorded as assets on the balance sheet.

A down payment is made in advance of the normal payment procedure. This may be to ensure certain works are started, or to recover or prevent a delay or to expedite certain materials. It might be accompanied by an advance payment bond.

On a construction project, a contractor may, for example, request an advance payment to help them meet significant start up or procurement costs that may have to be incurred before construction begins. For more information see: Advance payment.

A down payment chain documents multiple transactions to help organisations monitor costs through a series of partial invoices. When the job is completed, a final invoice is prepared to reflect adjustments that have been made during the process.

In terms of accounting, down payment chains are designed to:

- Make data entry more efficient.

- Improve data processing.

- Clarify budgetary benchmarks.

- Control activities around long-term accounting tasks.

There are two types of down payment chains: debit side or credit side.

Debit and credit side down payment chains are both constructed in the same manner. The only difference between the two is the incoming or outgoing payment data, which dictates whether the chain is debit or credit side.

The debit side down payment chain is suitable for transactions with customers. This can include invoice processing and transaction payments. It is designed to track receivables owed to customers along with corresponding incoming payments. It can also be used to gain insight into past and future payments.

The credit side down payment chain is suitable for transactions with vendors and subcontractors. This also includes invoice processing and transaction payments. It is designed to track payables owed to vendors and subcontractors (or other providers) along with corresponding outgoing payments. As with debit side down payments, it can also be used to gain insight into past and future payments.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

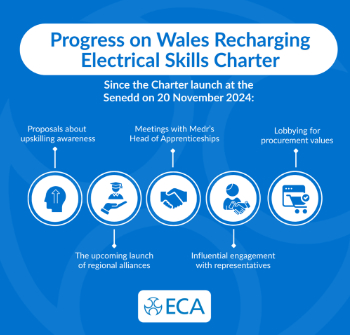

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.